Bitcoin’s popularity over the years may possibly have been a bit unnecessarily harsh. Even though more and more Australians buying on the crypto train, some are still unclear about the legalities surrounding crypto and whether it is even legal.

The short reply is yes. Bitcoin and other cryptocurrencies were announced legal in 2017 by Australia’s central bank, the Reserve Bank of Australia. Then again, like most things, there are regulations and obligations when it comes to trading cryptocurrency in Australia. In this post, we’ll talk over the legalities of Bitcoin and cryptocurrency in Australia as well as tax obligations.

Bitcoins Legalisation

Perhaps some of the misunderstanding about whether Bitcoin is legal or not comes from the fact that there was a time when it wasn’t technically legal.

It wasn’t until 2017 that cryptocurrencies were declared legal in Australia.

That statement also made cryptocurrency and other blockchain projects subject to anti-money laundering laws under the Counter-Terrorism Financing Act 2006. Furthermore, like other capital gains assets like stocks and real estate, cryptocurrency became subject to tax in 2017.

The tax element offers the most likely risk to inadvertently get Australians into legal strife by incorrectly stating their taxes. More on that later.

Bitcoin has also been scrutinised from a legal point of view because, in 2019, more than $515 million was spent on illegal activities with Bitcoin, including money laundering. No, Bitcoin itself wasn’t the illegal factor (more so the money washing) but being entangled in such functions can shape the public perception of Bitcoin and other crypto assets.

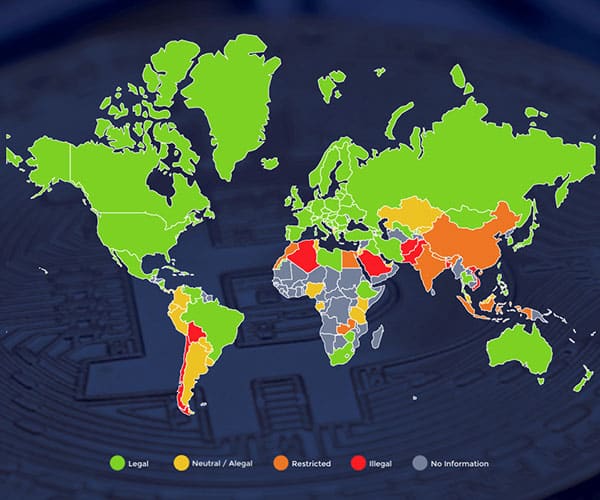

This is why crypto stays illegal in some countries. Yes, the anonymity and decentralisation of its transactions gives you many benefits. Still, it also implies that it’s relatively straightforward moving crypto assets from one country to another with no government control.

A practice many have used for less than legal purposes.

Are digital currencies regulated in Australia?

Rarely, if at any time, does the Australian government legalise a service without regulations in place, and cryptocurrency is no exception.

Like most things in the digital world, the restrictions around cryptocurrency have evolved and will likely continue to do so.

Following the legalisation of Bitcoin and other cryptocurrencies, the Australian Transaction Reports and Analysis Centre (AUSTRAC) announced the planned implementation of more serious regulations around cryptocurrency and cryptocurrency exchanges.

One major regulation is that any cryptocurrency exchange that functions within Australia must be registered with AUSTRAC.

If an entity acts as an exchange or gives you registrable exchange type services, they must:

- Maintain records

- Verify and identify all of their users

- Comply with government AML/CTF reporting requirements (specifically Part 6A – the Digital Currency Exchange Register)

It is the responsibility of AUSTRAC’s CEO to update and maintain the Digital Currency Exchange Register. Any exchanges that are unregistered may be subject to both financial and criminal penalties.

ICO regulations

Since then, the Australian Securities and Investments Commission (ASIC) has also released updated regulations around initial coin offerings (ICOs).

For those unfamiliar with ICOs, they’re a popular form of fundraising. They can be compared to initial public offerings (IPOs) and are a way for investors to buy into companies. While IPOs offer shares, ICOs offer crypto tokens.

ICO regulations come under Australian Consumer Law, where the company can not engage in inaccurate or deceptive conduct.

In August last year, further regulations were also set in place that required exchanges to delist a category of anonymous cryptocurrency or privacy coins like XMR.

Crypto and Bitcoin tax obligations

Yes, absolutely.

Cryptocurrency can be subject to both capital gains tax (CGT) and income tax.

Below we contact on the key differences, but we propose looking at our Australian Crypto Tax Guide for a more comprehensive overview.

In the case of income tax, this is typically arranged for what is referred to as ‘traders’. Cryptocurrency traders are sole traders or independent businesses where the prime source of their business income is, or is directly related to, cryptocurrency.

This could be exchanges, professional cryptocurrency traders, or any business that undertakes its activity for commercial purposes.

Paying CGT on crypto profits

The majority of cryptocurrency investors in Australia will be subject to capital gains tax, or CGT.

You incur CGT when you engage in any of the following:

- Selling or gifting cryptocurrency

- Converting cryptocurrency to a fiat currency, such as AUD

- Trading or exchanging cryptocurrencies

- Using Bitcoin or other cryptocurrencies to purchase goods and services

In the case of CGT on crypto investments – which are becoming an increasingly popular way to diversify portfolios – tax is only applied when you dispose of the asset.

One other area which is often overlooked or anonymous to many Australians is using crypto exchanges.

Of course, there are a few caveats to the above.

CGT doesn’t apply in the case of personal use assets. For example, when you aren’t working with cryptocurrency in the course of business or as an investment.

If you’re a small confused by the above, you’re not alone. This is why it’s important to talk to tax professionals and use reputable exchanges that can assist with providing information to meet your tax obligations.

Is Bitcoin Safe to Buy?

For the most of the time, that answer is yes.

Make sure that you’re using legitimate exchanges to purchase your Bitcoin or other cryptocurrencies. They will need to have some form of KYC (Know Your Customer) or identity verification process before you are allowed to begin trading. When in doubt, do your research.

The other factor to take into account is that investing in cryptocurrencies is like investing in any other speculative asset: its value will fluctuate. Crypto markets are highly volatile so it’s fundamental to conduct thorough research to avoid badly timed purchases (buying before a crash). Another way of mitigating the risk of poorly timed purchases is to dollar cost average. This is a trading strategy that requires investing small amounts into Bitcoin over regular intervals (i.e. every week).

No investment is ever a guarantee and the risk of a drop in value will always be present.

Another thing to look into is cyber theft. If a bank were to get robbed, there’s government backing in place to cover the theft of any of their customers’ money. This isn’t the case with cryptocurrency digital wallets.

Make sure that you’re correctly storing your coins in a reputable cryptocurrency wallet.

Conclusion

All bias aside, Bitcoin and other cryptos are legal, and truth be told there is a general consensus they are safe.

With that said, the best way to play it safe is to train yourself. Be aware that crypto is subject to many of the regulations and laws of fiat currency.

It’s also vital to be aware of exactly what tax obligations apply to you. You’d certainly not be alone in finding tax laws confusing, and this may be even more so for crypto.

Regardless of whether you exchange your crypto assets for fiat currency or another digital currency, CGT can still apply. Many accountants do specialise in taxation around digital assets so, when in doubt, utilise a professional. It’s a small price to pay to avoid any legal strife a lack of knowledge may land you in.

Do your homework before you purchase Bitcoin or any other cryptocurrency. This contains everything from research into the currency itself (its historic market value, perceived volatility etc.) to how you propose to purchase or exchange the cryptocurrency. If you’re applying an exchange, are they reputable? What safety activities do they have in place? Ensure you’re also using a reputable digital wallet.