Expanding Your Business into Australia

Considering a business expansion into Australia?

This guide provides a roadmap for navigating the exciting possibilities and important considerations of entering the Australian market.

Choosing Your Presence:

- Light Presence: Ideal for online ventures or minimal local operations. Maintain your foreign business status and utilise services like:

- E-commerce fulfilment via Australian providers

- Local sales representatives

- Full Presence: Establish a strong local foothold with an Australian subsidiary company. This allows for:

- Direct invoicing of customers

- Employing local staff

- Access to a wider range of business opportunities

Key Considerations:

- Compliance: Australian laws and regulations govern everything from taxation to employment. Seeking guidance from Australian accountants ensures a smooth transition.

- Speed to Market: Striking a balance between swift entry and necessary legal and administrative processes is crucial.

- Cost-Effectiveness: Explore options like outsourcing specific tasks (HR, accounting) to minimise overhead.

- Taxation: Understanding Australian tax structures, including GST (Goods and Services Tax), is essential for financial planning.

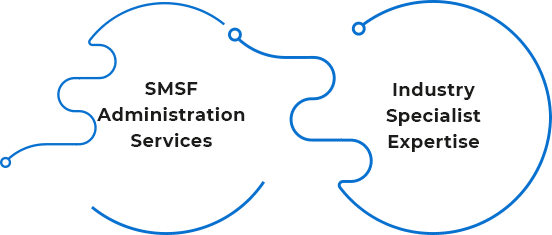

International

International

Business

Business

Personal

Personal

SMSF

SMSF